The Curious Case of Duexis

Aaron Hakim, MS and Joseph S. Ross, MD, MHS

JAMA Intern Med. Published online January 23, 2017. doi:10.1001/jamainternmed.2016.8423

Approximately 13% of health care expenditures in the United States are for prescription drug spending, nearly $420 billion in 2015. High-priced pharmaceuticals, therapies that cost more than $600 per month, are projected to eclipse 50% of total drug spending by 2018. Price increases for these therapies have been persistent, with unit costs increasing 164% between 2008 and 2015. Pharmacy benefit managers are third-party administrators that process and pay prescription drug claims and negotiate drug prices with manufacturers.

Pharmacy benefit managers have sought to manage prescription drug use and mitigate cost increases through such measures as prior authorization and step therapy requirements for physicians, increased copayment requirements for patients, and exclusion of some expensive medications from health plan formularies. Using the illustrative example of Duexis, a single-tablet, fixed-dose combination of the nonsteroidal anti-inflammatory (NSAID) ibuprofen [Advil] and the histamine H2-receptor antagonist famotidine [Pepcid] marketed by Horizon Pharma (Dublin, Ireland), we describe how some pharmaceutical companies have sought to circumvent such restrictions and maintain high prices for drugs, even for those with generic alternatives.

Duexis was approved by the US Food and Drug Administration (FDA) in 2011 to relieve symptoms of osteoarthritis and rheumatoid arthritis and to decrease the risk of developing gastric and duodenal ulcers in patients at risk for NSAID-associated ulcers. After approval, Duexis was first marketed at an average wholesale price, a benchmark used for pricing and reimbursement of prescription drugs, of $158.40 per month.

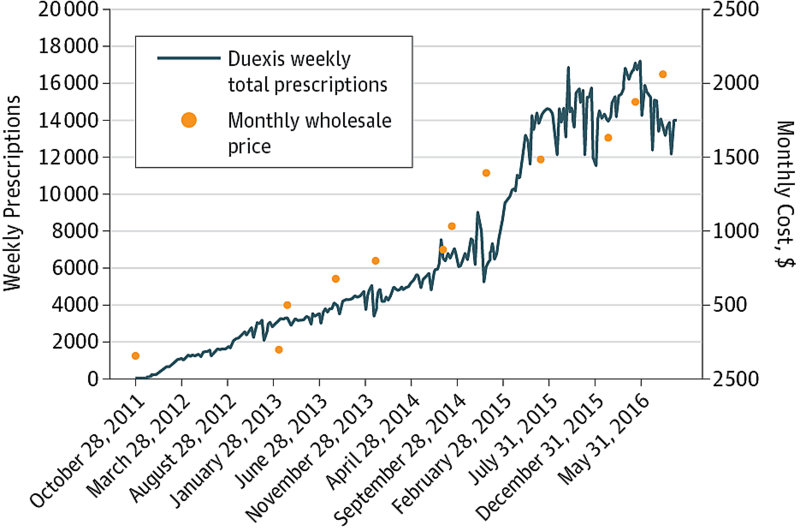

The drug is a combination of 2 over-the-counter medications that are sold as generics and would cost approximately $16 per month if purchased separately at the same doses. Since 2012, Duexis has had 11 price increases (see Figure below). As of August 12, 2016, the monthly wholesale price was $2061, representing a 1131% aggregate increase. In 2015, nearly $200 million was spent on Duexis in the US, with estimated cumulative revenue over 5 years of more than $600 million since FDA approval.

Figure

Weekly Prescriptions for Duexis and Monthly Wholesale Price After Each of the 11 Price Increases Since October 2011, When Duexis Was First Made Available in the United States

Pharmaceutical companies employ several tactics to offset prior authorization, step therapy, and other utilization controls imposed by pharmacy benefit managers on physicians. Horizon, for example, has physicians submit Duexis prescriptions directly to an affiliated mail-order specialty pharmacy, which prepares the prior authorization paperwork and provides medical justification to the pharmacy benefit manager on behalf of the physician, reducing the administrative burden. Horizon reports that 70% of Duexis prescriptions are filled through their “Prescriptions Made Easy” specialty pharmacy program. One such specialty pharmacy, Linden Care, has 59% of its business dedicated to dispensing drugs made by Horizon Pharma. In 2016, the US Attorney’s Office for the Southern District of New York was investigating Horizon’s specialty pharmacy practices.

Click here to read the full article in the Journal of the American Medical Association (JAMA).